Nifty Exchange Traded Funds (NIFTY ETF)

Nifty Exchange Traded Funds (ETFs) are designed to invest in the stocks that make up the Nifty 50 Index. The primary goal is to mirror the performance of the index by purchasing the same stocks in the same proportions as they appear in the index. The Nifty 50 Index serves as the benchmark index on the National Stock Exchange and encompasses the 50 most liquid stocks of the largest companies in the market.

What are the benefits of investing in Nifty ETFs?

Reduced risk:

Nifty ETFs focus on blue-chip stocks listed on the Nifty Index, which are typically the leading companies in the country. It is widely believed that blue-chip companies offer steady long-term returns and protection against market fluctuations. For instance, the ICICI Prudential Nifty ETF has allocated approximately three-fifths of its assets to the top ten companies in its portfolio.

Source: ICICI Prudential

More affordable alternative:

Instead of purchasing individual blue-chip stocks, investors can opt for Nifty ETFs, which offer a cost-effective way to invest in a diversified portfolio of blue-chip companies. Buying individual stocks can be costly, with prices for companies like Reliance Industries and HDFC trading at high levels. Investing in stocks from all 50 companies can significantly impact your finances. In contrast, Nifty ETFs allow investors to access blue-chip companies in a more budget-friendly manner.

No need for extensive research:

Many individuals shy away from stock market investments due to a lack of expertise. However, Nifty ETFs eliminate the need for extensive research, as they track the stocks included in the Nifty 50 Index. Additionally, investors benefit from the Nifty Index's policy of replacing underperforming companies with better-performing ones, ensuring that only top-performing companies remain in the index.

Benefits of Nifty ETFs

Easy to grasp:

Unlike mutual funds where investors rely on the expertise of fund managers, Nifty ETFs operate without bias or judgment when purchasing stocks – they simply buy stocks that are part of the Nifty.

Immediate diversification:

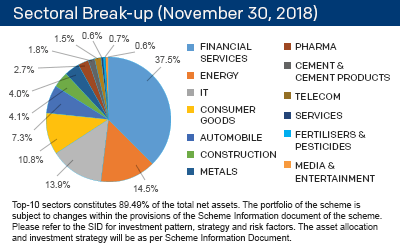

The Nifty Index comprises the 50 most valuable stocks across a variety of sectors within the Indian economy. Consequently, investing in Nifty ETFs provides investors with diversification, a crucial factor in reducing risk. Some of the sectors covered by ICICI Prudential Nifty ETF include:

- Software

- Petroleum products

- Consumer non-durables

- Finance

- Auto

- Construction project

- Pharmaceuticals

- Power

- Ferrous metals

Source: ICICI Prudential

For instance, let’s assume that IT and pharmaceutical sectors are under performing. In this case, the investor can still rely on the remaining sectors to offset the losses.

High liquidity:

Nifty ETFs prices are updated throughout the day, which allows investors to trade them at any time of the day. On the other hand, mutual fund prices are updated at the end of the day, compelling investors to give their buy or sell order without knowing the real-time value of the fund.

Easy on the pocket:

Nifty ETFs are passively managed. In simple words, fund managers don’t have to rely on their research to pick the right stocks. All they need to do is ensure that the ETF has bought the Nifty stocks in the right proportion. That’s the reason why the expense ratio is the lowest among all mutual funds. For example, the ICICI Prudential Nifty ETF has an expense ratio of just 0.05% per annum. Lastly, the Nifty ETF doesn’t have a ‘load’ scheme for joining or leaving the fund.

Stable returns:

Since Nifty ETFs invest in blue-chip companies, these funds suit investors who are looking to invest for the long haul but with limited risks. For instance, ICICI Prudential Nifty ETF has delivered 10.34% returns (for SIP investors) and 12.59% (for lumps investors) since its inception in March 2013. There is a slight variance in the delivery model because SIP returns are calculated by XIRR approach and the lumps returns are in CAGR .

| Period | Scheme (SIP) | Nifty 50 (SIP) | Scheme (lumpsum) | Nifty 50 (lumpsum) |

|---|---|---|---|---|

| 1 year | 4.36% | 4.25% | 7.69% | 7.82% |

| 3 years | 12.29% | 12.41% | 12.41% | 12.54% |

| 5 years | 11.03% | 11.14% | 13.21% | 13.37% |

| 7 years | NA | 12.36% | NA | 13.69% |

| 10 years | NA | 12.03% | NA | 16.10% |

| Since inception | 11.68% | 11.80% | 13.31% | 13.47% |

Source: ICICI Prudential

Inception date: 20-Mar-13; Initial SIP instalment date: 01-Apr-13

Note: For lumpsum performance, returns of less than 1 year are shown in Absolute terms, while returns of greater than 1 year are shown in CAGR terms. For SIP performance, the returns are calculated using the XIRR approach, assuming a SIP investment of Rs 10,000 on the 1st working day of every month in the Scheme. XIRR helps to accurately calculate the return on investments, considering the time impact of the transactions. The scheme's performance is benchmarked against the Total Return variant of the Index. Past performance may or may not be sustained in the future.

Differences between Mutual Funds and Exchange-Traded Funds

| Parameter | Mutual Fund (MF) | Exchange-Traded Fund (ETF) |

|---|---|---|

| Definition | An MF is a professionally managed investment tool which involves the collection of resources from multiple investors. | An ETF is an investment scheme that tracks a specific index. ETFs are listed and traded on a stock exchange. |

| Disclosure of holdings | MFs are required to disclose their asset holdings on a quarterly basis. | For ETFs, the disclosure of holdings is done on a daily basis. This ensures greater transparency. |

| Fractional shares | MF investors can buy fractional shares-that is, less than one share of a stock, such as half a share or a third of a share. | Fractional shares are not available to ETF investors. |

| Share price | MF units are traded only once at the end of the trading day. That is why MF values do not keep shifting. | The prices of ETF shares fluctuate throughout the day as the shares are traded on the stock exchange. |

| Transaction price | In MFs, fund units are traded at the Net Asset Value (NAV), which is calculated when the trading day ends. | In ETFs, the funds are traded on the quoted market price, similar to the trade in stocks. |

| Transaction process | To buy or sell MF units, the investor has to place a request with the fund house. | ETFs can be freely traded within market hours at the investor's convenience. |

| Taxation | 15% short-term capital gains (STCG) tax applies to equity MFs held for less than a year. Long-term capital gains tax (LTCG) of 10% applies to returns of more than Rs 1 lakh on equity MFs. LTCG under Rs 1 lakh are tax-free. | ETF returns enjoy the LTCG tax benefit only if held for more than three years. Otherwise, the STCG tax applies. |

| Trading account | You don't need a trading account to invest in MFs. | You need a trading account to start investing in ETFs. |

| Management | MFs need active managers for assets to perform. | ETFs don't need active managers. The management here is passive since the ETF needs to match a specific index |

| Fees and commissions | Fund management fees may be high as MFs require the fund manager to take active decisions. However, no commissions are charged for buying and selling MF units. | Fees tend to be lower as an ETF tracks a specified index and does not need active management. But, like with stocks, investors may need to pay commissions when trading ETF units. |

| Lock-in period | Some MFs like the Equity-Linked Savings Scheme (ELSS) come with a three-year lock-in period. | There is no minimum holding period for ETFs. |

Source: ICICI Prudential

Discover the leading ETFs that are outperforming the rest.

Here are the top 3 NIFTY-benchmarked ETFs with impressive 3-year returns:

- Edelweiss Exchange Traded Fund-Nifty 50 – 16.15%

- UTI Nifty Exchange Traded Fund – 15.71%

- SBI ETF Nifty 50 – 15.68%